Us Corporate Tax Rates 2025-25. Fp staff july 23, 2025, 17:05:22 ist. The top marginal income tax rate.

Implementing a billionaire minimum tax of 25% on the wealthiest taxpayers. Corporate tax rate on foreign companies reduced from 40% to 35%.

A company shall be liable to pay minimum alternate tax (mat) at 15% of book profit (plus surcharge and health and education cess as applicable) where the normal tax liability of the.

2025 Tax Rates And Deductions Table Kaela Clarine, The 2025 tax brackets apply to income earned this year, which is reported on tax returns. There are seven income tax rates for the 2025 tax year, ranging from 10% to 37%.

Corporate tax definition and meaning Market Business News, Surcharge is an additional charge levied for persons. 10 percent, 12 percent, 22 percent, 24 percent, 32 percent, 35 percent, and 37 percent.

Budget 2025 On Tax Image to u, You pay tax as a percentage of your income in layers called tax brackets. The general slab rates applicable in the case of an individual or huf are 5%, 20%, and 30%.

United States Corporate Tax Rate 2025 Mamie Kayley, Learn about exemptions, conditions, and implications for companies. The 2025 tax brackets apply to income earned this year, which is reported on tax returns.

Tax rates for the 2025 year of assessment Just One Lap, Surcharge, marginal relief and health & education cess. The general slab rates applicable in the case of an individual or huf are 5%, 20%, and 30%.

State Corporate Tax Rates and Brackets, 2025 Taxes Alert, Foreign companies’ tax rate reduced to 35%. For information on the implementation of the minimum tax.

What Is Corporation Tax Rate 2025 Kimmi Merline, Implementing a billionaire minimum tax of 25% on the wealthiest taxpayers. 10 percent, 12 percent, 22 percent, 24 percent, 32 percent, 35 percent, and 37 percent.

2025 Tax Rates And Standard Deduction U/S Rey Modestine, The federal income tax has seven tax rates in 2025: The headline cit rate is generally the highest statutory cit rate, inclusive of surtaxes but.

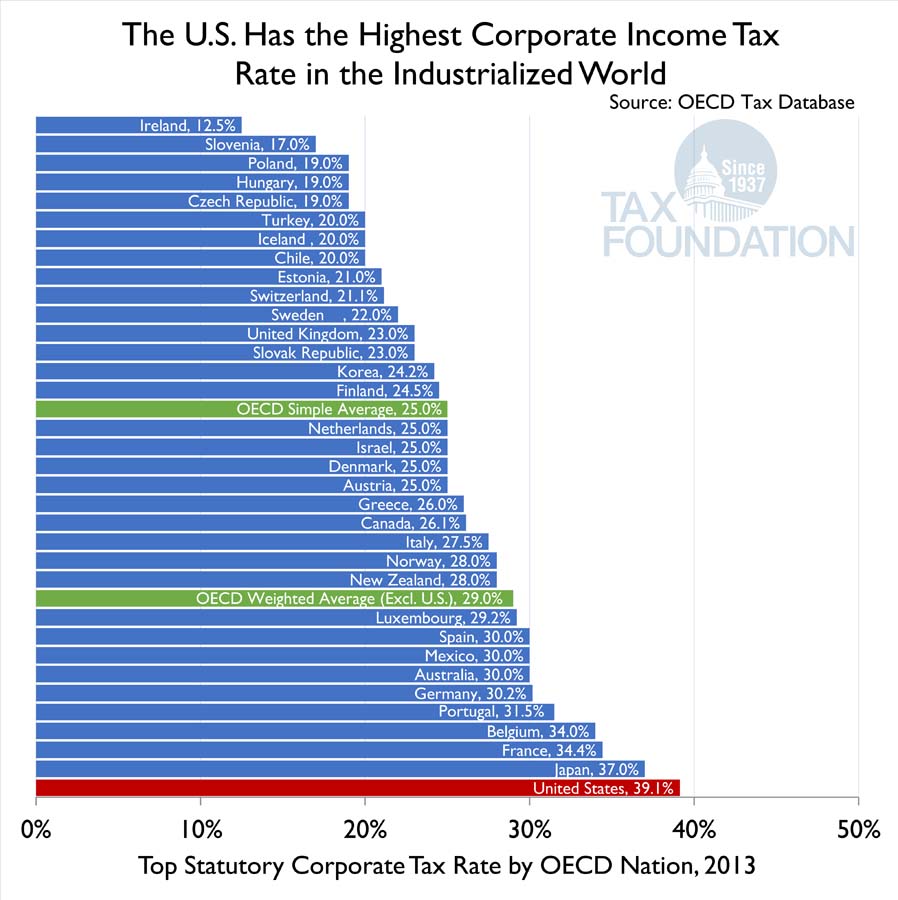

The U.S. Has the Highest Corporate Tax Rate in the OECD, The highest slab rate of 30% applies on income exceeding rs. The following corporate and withholding tax rate changes apply as from 1 january 2025 (unless otherwise noted).

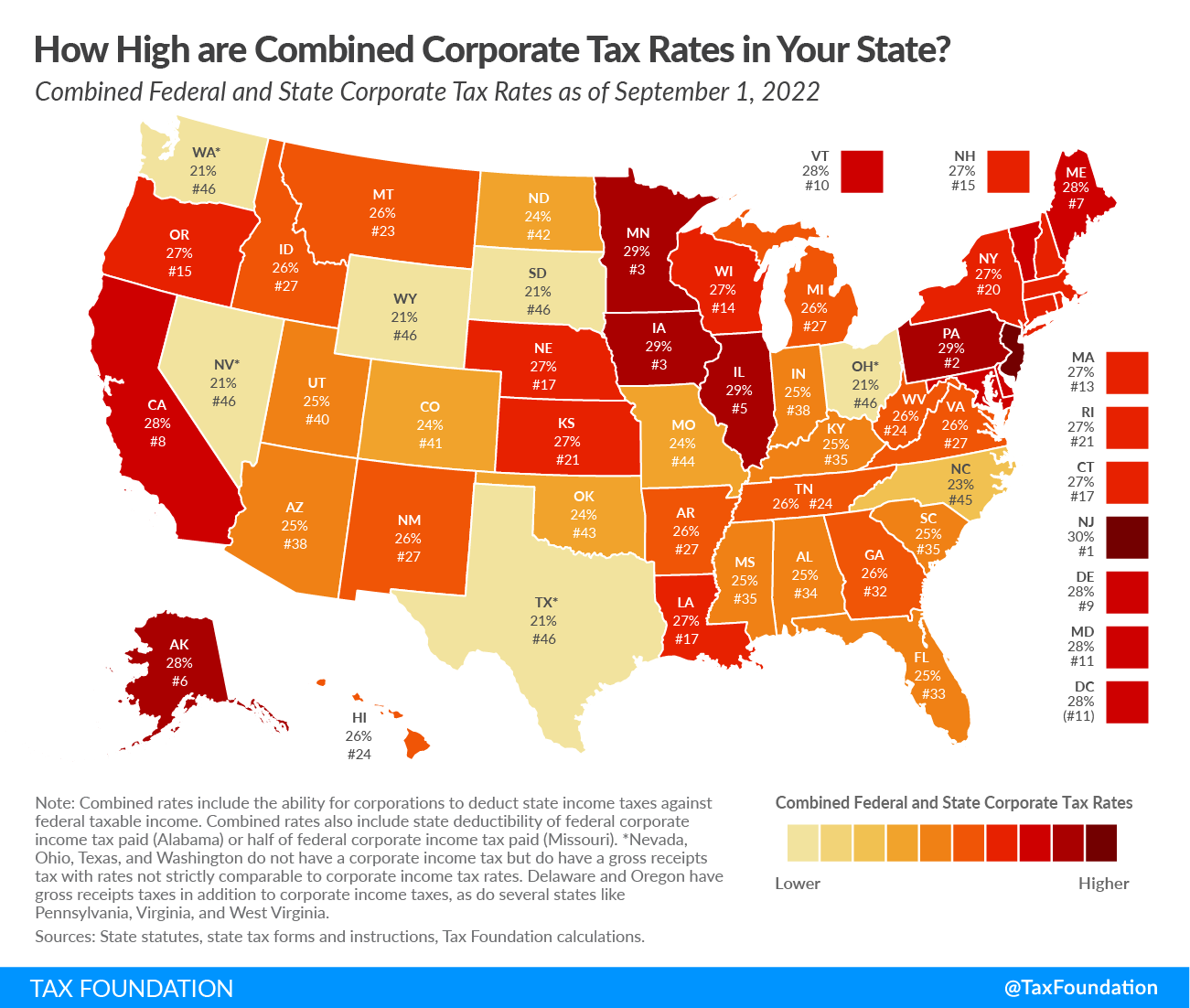

How High are Combined Corporate Tax Rates in Your State? Tax, 10%, 12%, 22%, 24%, 32%, 35% and 37% (there is also a zero rate). For information on the implementation of the minimum tax.